Impact of GST on Musical Instruments

GST Return On Musical Instruments

When the new tax law was applied last year, it put all musical instruments and parts for it under Chapter 92. In this article, we take a look at what is the GST Return on musical instruments.

Musical instruments were divided into two categories for the purpose of tax. The first includes all indigenous and handmade instruments. These are exempt from any tax. All other kinds of musical appliances and part are taxable under GST at the rate of 28%. While the classification should have made the process simpler, it led to more confusion.

For instance, even if a guitar is made in India, it is not exempt from tax because it falls under the purview of western instruments. Understanding what is truly handcrafted and indigenous is tricky. Therefore, to help our readers make a note of the instruments that are taxable under GST, we give a list below.

What Musical Instruments Are Taxed At 28% GST?

- Every percussion instrument such as drums, maracas, cymbals, xylophones, and castanets.

- All kinds of pianos and stringed instruments such as harpsichord. Automatic pianos are also included.

- All musical instruments that require electricity to produce or amplify sounds like accordion and organs.

- Every string instrument such as harps, guitars (including electric) and violins.

- All musical instruments played through wind such as bagpipes, keyboard pipe organs, clarinets, and trumpets.

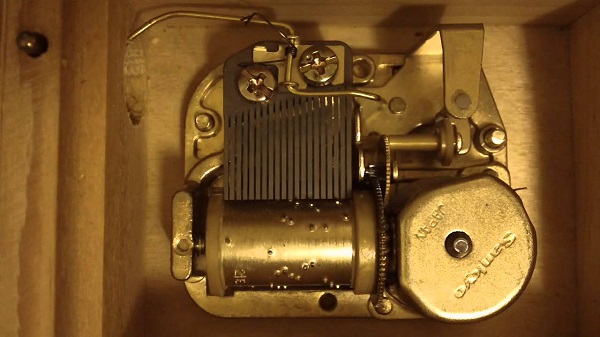

Here- Check Out more about the impact of GST on musical instruments. Even mechanical street organs, singing birds, musical boxes, whistles, fairground organs, and call horns are taxed at 28% GST. The parts for all these musical instruments and any accessory are taxable too. This list includes:

- mechanisms for musical boxes

- cards, discs, and rolls

- metronomes

- tuning forks

- pitch pipes

Prior to GST, the tax on a musical instrument, made in India or abroad was not too high. For instance, in Karnataka, it was 5.5% and 14.5% respectively. This massive hike of GST on some musical instruments has put a hit on the sector. Amateurs and learners of music are not buying instruments because even a mere five hundred rupees raise in price falls heavy on their pockets. The lack of sales consequently affected the business of retailers. To offset the drop in sales, the discount being offered have been reduced drastically. While before GST a 15% discount was very much feasible, today musical instrument shops only go as high as 5% discount.

The exemption of GST on indigenous instruments was to empower local business and motivate artists to learn them. The move was commendable, but music is an art form and extremely educational, making it luxury by applying a 28% tax may not result in the outcome experts hoped.

The direct effect of GST has been detrimental. Instead of buying musical instrument parts from India, individuals are purchasing it abroad because the cost is less.

What Is The GST For Other Music Equipment And Accessories?

- There is some good news. Only 18% of GST applies to CDs, Tapes, DVDs, and USBs. The same is applicable for solid-state non-volatile storage tools such as smart cards. Any media used for recording sound, video, or any other phenomena are also taxed at 18%.

- Sound recorders, sound re-producers, and headphones come under chapter 85 of the GST. All these gadgets and apparatuses are taxed at 28% just like most musical instruments.

- Radios, loudspeakers, amplifiers (both audio-frequency and electric-sound) and other audio equipment have a 28% GST. In the case of radios, it doesn’t matter if they are combined with sound recording technology, clocks, or sound reproduction. All of them are taxed at the same rate because they are categorised as “reception apparatus for radio broadcasting.”

In the first glance, it appears as if GST burdened the musical instrument industry. The truth is slightly different. The import duties on most instruments were reduced, which counter-balances the increase in tax. As a consequence, the overall impact of GST remains almost negligible.

Through this article, we wanted to shed an accurate light on what GST is applicable on which musical instrument, apparatus, and accessory because the layman was largely unaware. We hope we provided an accurate, clear, and concise picture to you.